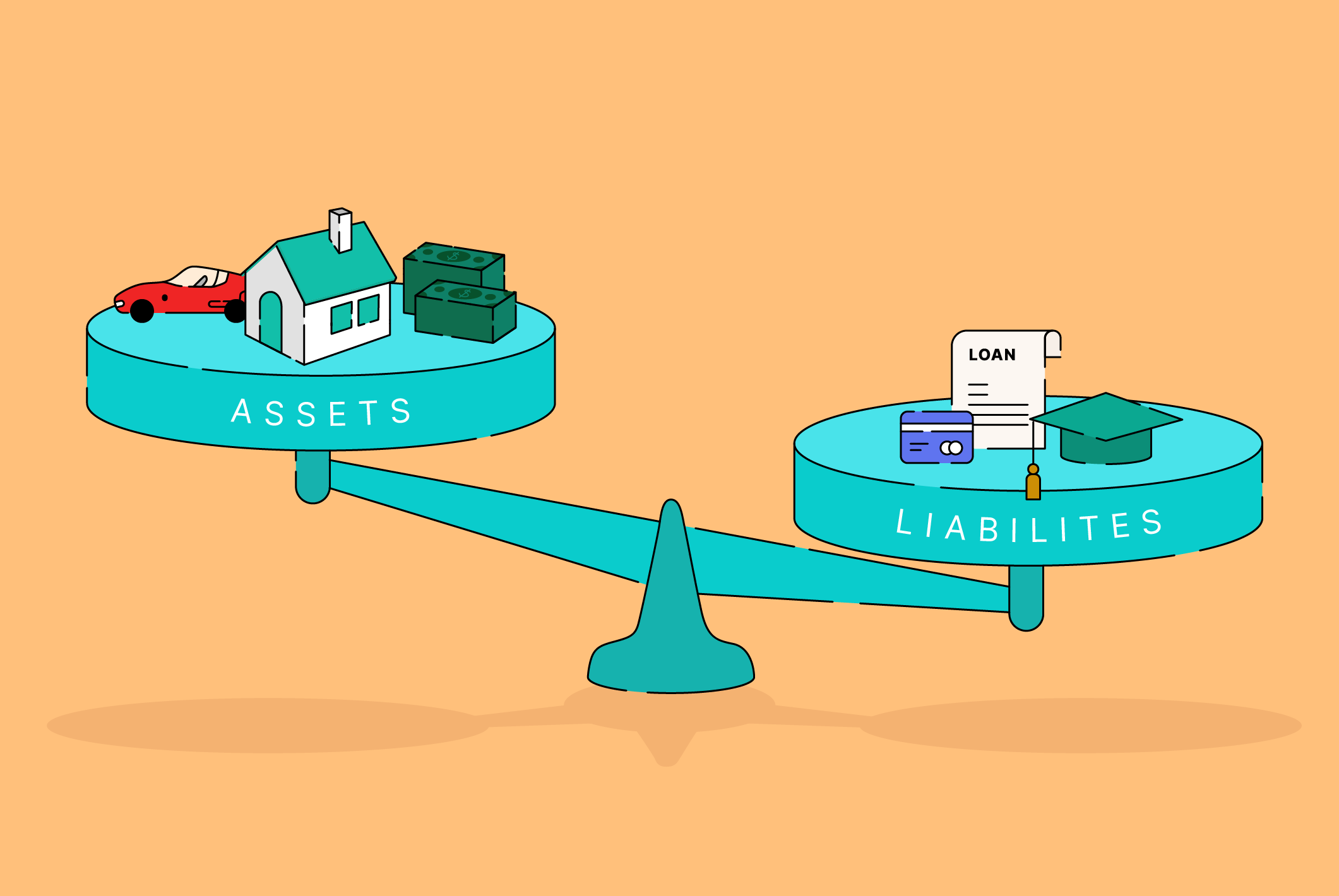

When it comes to managing money, most people focus on budgeting, spending less, or earning more. While these are important, they don’t give you the complete picture of your financial health. The true measure of your progress is your net worth — the difference between what you own (assets) and what you owe (liabilities).

Many people review their net worth once a month, but there’s a smarter approach: weekly net worth tracking. Done right, it can give you sharper insights, keep your momentum alive, and help you make better decisions faster. And with NetTrack, it’s effortless.

Why Weekly Net Worth Tracking Wins

- Catch Trends Early

Waiting a month to check your net worth can let small problems grow into big ones. Weekly check-ins mean you’ll spot changes — like rising expenses, unexpected debt, or investment shifts — before they snowball. - Build Consistency

Like stepping on a scale when you’re working on fitness, weekly tracking keeps you focused. It turns financial health into a consistent habit rather than a “once in a while” task. - Celebrate Micro-Wins

Watching your net worth grow week by week — even in small amounts — is motivating. Those micro-wins keep you engaged and excited to keep going.

How NetTrack Makes It Effortless

Tracking your net worth weekly sounds like work, but NetTrack automates the process so it’s easy and accurate:

- Auto-Sync Accounts

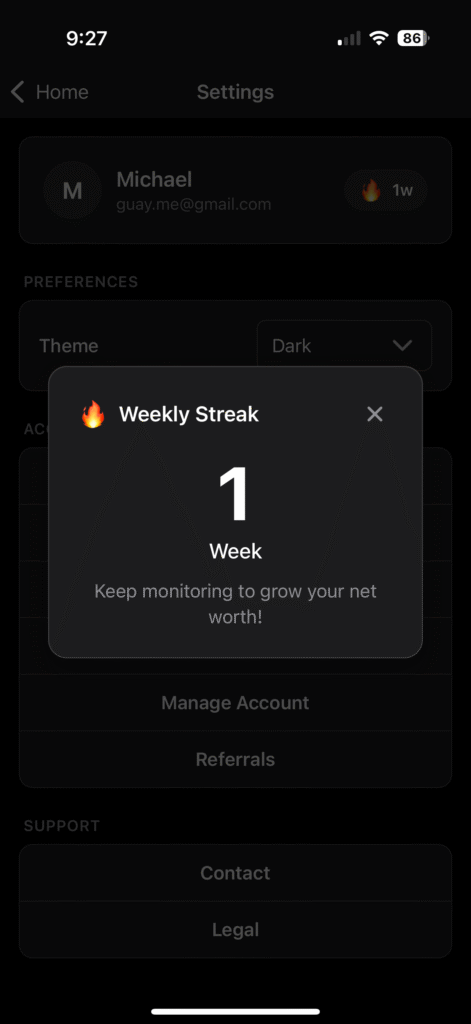

Link your bank accounts, credit cards, loans, and investments, and NetTrack will automatically update your net worth in real time. - Weekly Streak Tracking

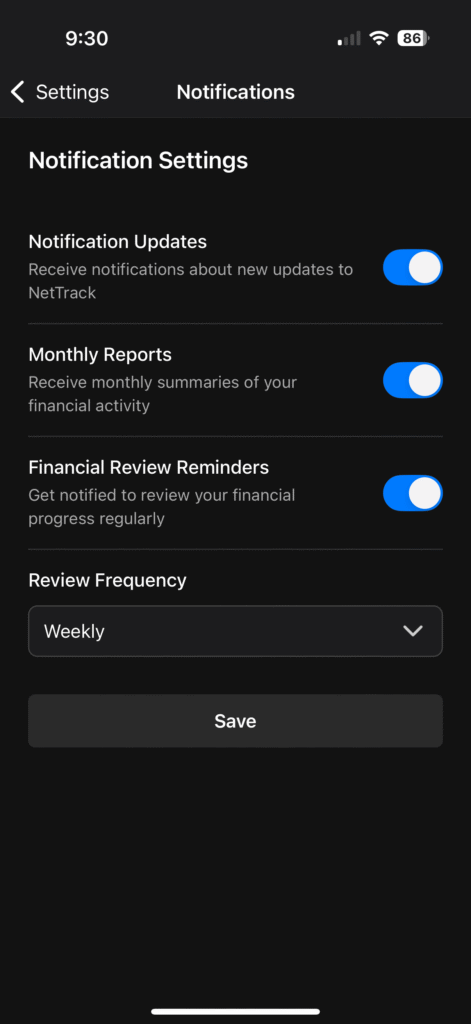

Keep your motivation high by building streaks — the longer you stay consistent, the more rewarding it feels. - Smart Reminders

Get gentle nudges when it’s time to check in, so you never break your habit. - Visual Trends & Insights

See exactly how your assets and debts change over time, helping you make smarter money moves.

The Psychology of Weekly Accountability

- Instant Feedback

No waiting a month to see results. Weekly tracking gives you immediate visibility into what’s working and what’s not. - Greater Control

Regular check-ins give you the chance to adjust your budget, increase savings, or reduce unnecessary expenses quickly. - Positive Momentum

Financial habits stick when you see progress often. Weekly check-ins keep your mind focused on growth.

Quick Start Guide: Your Weekly Net Worth Routine

Step 1: Sign Up & Connect

Create your free NetTrack account and securely connect your accounts for automatic updates.

Step 2: Enable Weekly Reminders

In your settings, turn on weekly notifications so you’ll always remember to check in.

Step 3: Check Your Streak

Stay motivated by maintaining your streak — a visual reminder of your consistency.

Step 4: Review Your Trends

Look for patterns in your spending, debt reduction, and savings growth.

Step 5: Adjust & Optimize

If you see dips, find the cause. If you see gains, keep doing what works.

Tips to Maximize Weekly Tracking

- Pick a Money Day

Choose the same day each week — like Sunday evening — for your check-in. - Look Beyond the Number

Your net worth is important, but so are the details: which accounts are growing fastest, which debts are shrinking, and what’s affecting your totals. - Celebrate Milestones

Mark achievements like “10 weeks of tracking” or “$5k net worth gain” to keep motivation high.

Final Thoughts

Weekly net worth tracking is more than just a habit — it’s a game-changer for financial clarity. It keeps you informed, motivated, and in control. With NetTrack handling the heavy lifting, you can focus on making decisions that move you forward.

Start your weekly tracking today — sign up for NetTrack, connect your accounts, and see how consistent check-ins can transform your money mindset.