We’re excited to roll out one of our most impactful NetTrack updates yet – focused on expanding coverage, improving investment clarity, and giving you more control over how your financial picture is calculated.

Whether you’re tracking your net worth daily or reviewing long-term investment performance, this release makes NetTrack even more powerful and accurate.

Thousands of New Financial Institutions Now Supported

We’ve significantly expanded our institution coverage with Plaid’s new OAuth-enabled connections.

This means:

- Thousands of additional banks, credit unions, and fintech platforms are now supported.

- Institutions like OnePay and many others can now be linked securely.

- More users than ever can seamlessly connect their accounts without manual imports.

If you’ve tried connecting to an institution in the past and it wasn’t supported, try again! There’s a very good chance it is now.

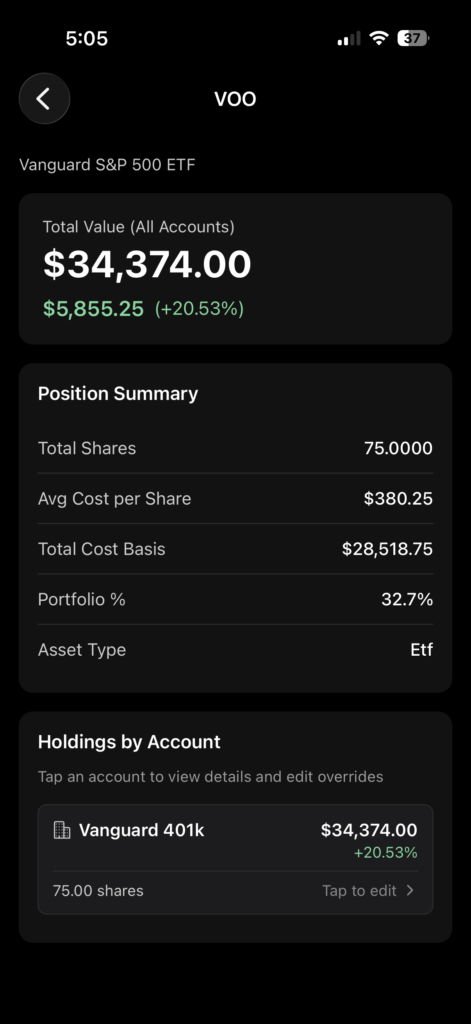

Investment Holdings Now Displayed at the Account Level

Previously, NetTrack grouped your investment holdings at a portfolio-wide level, which made it convenient but sometimes less granular.

Now you can:

- View holdings per account instead of just across all accounts.

- Compare performance between brokerage accounts, retirement accounts, and taxable portfolios.

- Understand where each investment is held and how it contributes to your overall net worth.

This unlocks deeper insight and helps you make more informed decisions.

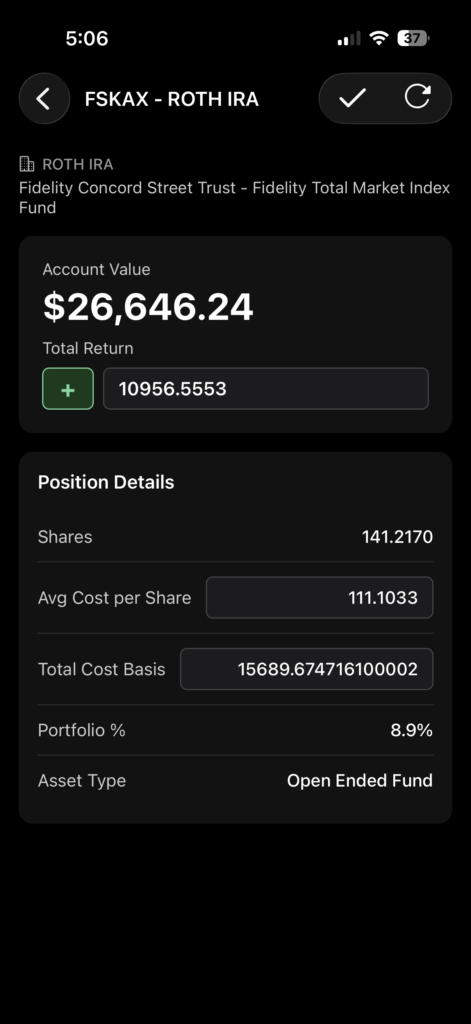

Manual Overrides for Investment Holdings (Cost Basis, Total Return, Avg. Cost)

Not all financial institutions provide complete or accurate cost-basis data – especially for older holdings or transferred accounts.

So we added something many users asked for:

You can now manually override holding details, including:

- Total return

- Cost basis

- Average cost per share

This ensures that your net worth and performance charts stay accurate, even when your institution’s data is incomplete.

It’s perfect for:

- Migrated brokerage accounts

- Legacy investments

- Correcting bad or missing cost basis

- Tracking manually added holdings

What’s Coming Next

Stay tuned – 2026 is going to be huge for NetTrack.

If you haven’t updated the app yet, now’s the perfect time.

And as always, thank you for helping shape the future of NetTrack. Your feedback directly drives what we build next.

As always, feel free to reply directly to this email or through the contact form in the app.

Leave a Reply