In the fast-paced world of personal finance, the ability to track investments effectively is crucial for anyone aiming for financial independence. Whether you are a seasoned investor or just starting, understanding your investment portfolio is essential to achieving your long-term financial goals. With NetTrack’s new investment tracking feature, planning your financial future has never been easier.

In this blog post, we will explore the importance of tracking investments, how NetTrack can help simplify this process, and actionable steps to optimize your financial strategy.

Why Tracking Investments Matters

1. Avoid Surprises

One of the greatest risks in investing is the unpredictability of the market. Without careful tracking, you may find yourself blindsided by sudden shifts in your investments. Regularly reviewing your portfolio allows you to stay ahead of these changes, mitigating losses and identifying opportunities before they slip away.

2. Measure Performance

How do you know if your investment strategy is working? Tracking your investments provides the data necessary to evaluate performance, helping you understand which assets are performing well and which may need further scrutiny or adjustment. A clear performance measure is vital for any investor looking to refine their strategy.

3. Goal Alignment

Investments should align with your long-term financial goals—whether that’s buying a home, funding education, or secure retirement. By keeping a close eye on how your portfolio is progressing towards these goals, you can make informed decisions and pivot as necessary.

The Features of NetTrack Investment Tracking

With NetTrack, tracking your investments has become a straightforward process. Let’s delve into some of the core features designed to help you manage your portfolio effectively:

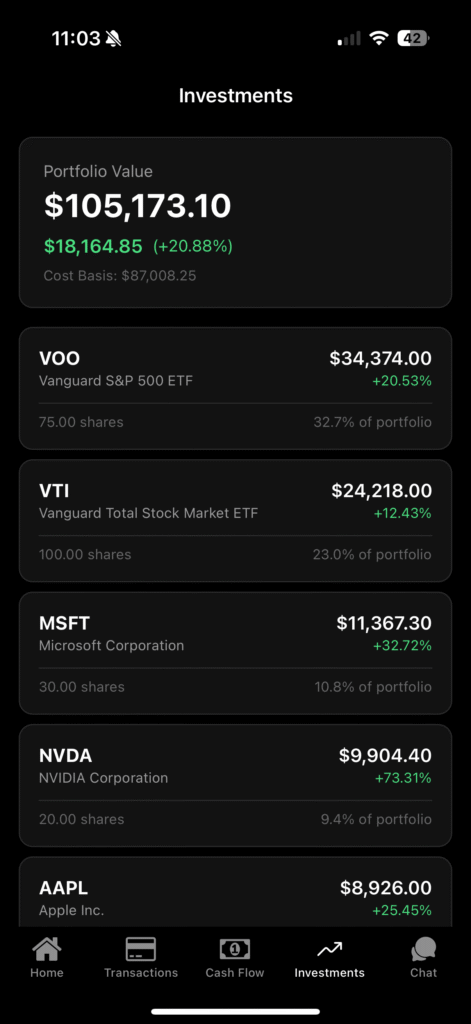

1. Centralized Dashboard

NetTrack simplifies your financial management by providing a centralized dashboard that displays all your investment accounts in one place. This allows you to quickly see how your investments are performing, compare assets, and make informed decisions on adjustments.

2. Real-Time Monitoring

Stay updated with real-time market data. NetTrack integrates seamlessly with different financial institutions, allowing you to track the performance of your assets without having to switch between multiple platforms. Knowledge is power, and with real-time updates, you can react quickly to market fluctuations.

3. Personalized Alerts

Set personalized alerts to notify you of significant changes in your investments. Whether it’s a drop in value, market news, or relevant changes in your investment opportunities, stay informed without the overwhelm.

4. Performance Analytics

Leverage advanced analytics to assess the performance of your investments. Understanding metrics like ROI (Return on Investment), asset allocation, and benchmark comparisons can help you determine whether your investment strategy is effectively working.

Actionable Steps for Effective Investment Tracking

To make the most of your investment tracking journey with NetTrack, follow these actionable steps:

1. Regular Assessments

Schedule regular assessments of your portfolio, ideally on a monthly or quarterly basis. During these reviews, check performance metrics and financial news to remain informed about market trends that may affect your investments.

2. Set Clear Goals

Define your investment objectives clearly. Are you looking for long-term growth, immediate returns, or capital preservation? Understanding your goals will help you structure your portfolio accordingly.

3. Diversification Analysis

Evaluate your investment diversification to ensure you’re not overly exposed to specific market sectors or assets. Diversification can lower risk and improve the potential for return over the long term.

4. Utilize NetTrack’s Features

Take full advantage of NetTrack’s investment tracking features. Set up alerts, use the dashboard for a quick overview, and rely on analytics to gauge your portfolio’s performance regularly.

The Road Ahead: Taking Control of Your Financial Future

Tracking your investments is not just a financial task; it is a fundamental aspect of taking control of your financial future. By integrating consistent tracking into your personal finance routine, you place yourself in a better position to take certain calculated risks, adapt your strategy, and ultimately reach financial independence.

NetTrack provides the tools to simplify this process, allowing you to focus more on your goals rather than the complexities of tracking investments. In a world where financial literacy is paramount, don’t leave your portfolio up to chance—embrace tracking today and set your course towards a prosperous future.

Conclusion

Investment tracking is an indispensable component of personal finance management. With NetTrack’s user-friendly investment tracking capabilities, you can keep your financial goals within reach, measure performance, and optimize your strategy. Start using NetTrack today to simplify your financial journey and make a significant leap towards achieving your net worth aspirations.

Engage with your finances like never before—track your investments with confidence and clarity using NetTrack’s simplified net worth tracker.

Leave a Reply