When it comes to money, most people focus on the obvious: budgeting, saving more, or finding the next “hot” investment. While these are important, they miss the foundation of personal finance — tracking your net worth.

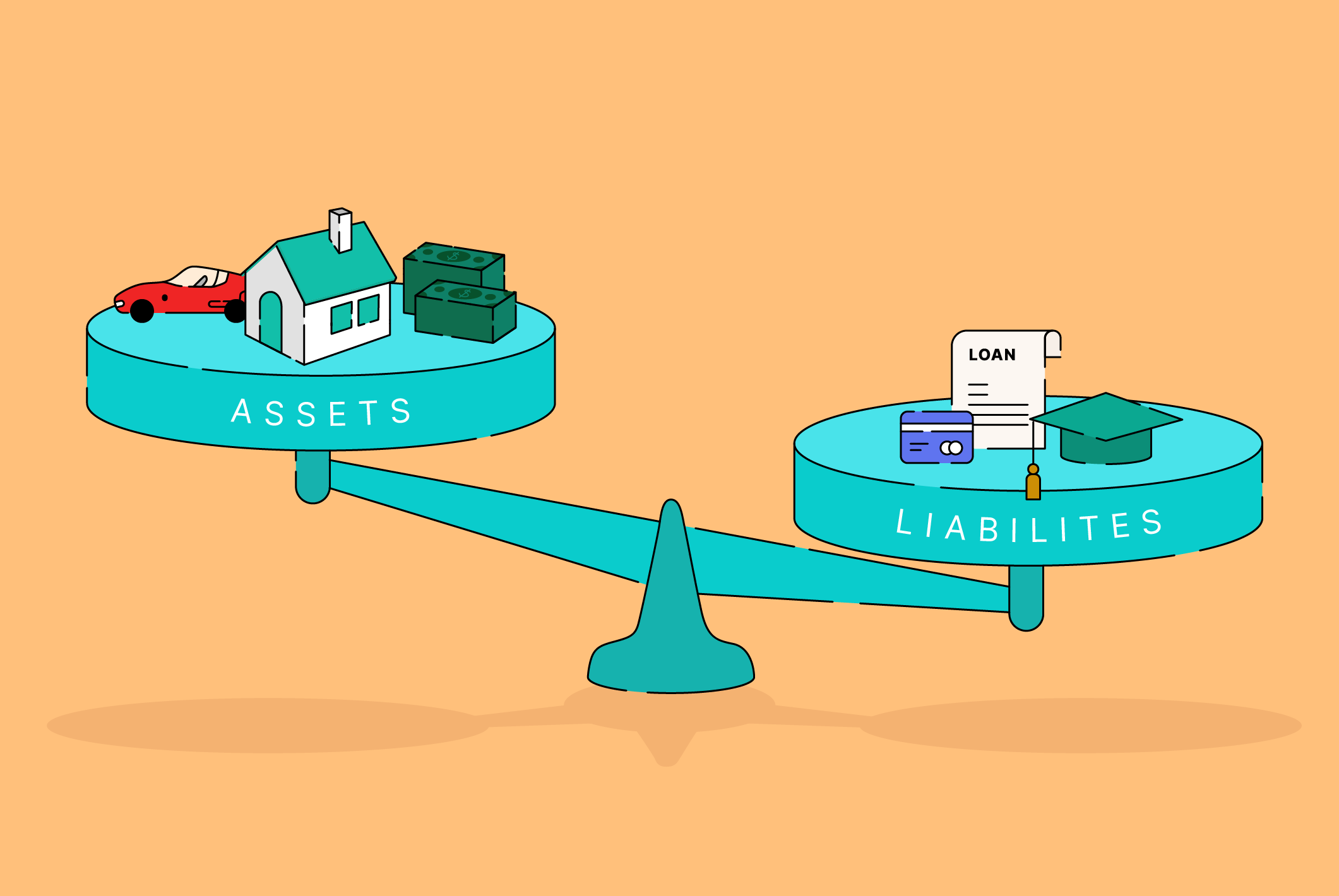

Net worth is your assets (cash, investments, property) minus your liabilities (debt, loans, credit cards). It’s a single number that tells you how well your financial life is really working.

And here’s the truth: tracking your net worth consistently is the single best financial habit you can build. It doesn’t require complex spreadsheets or hours of planning. Just a few minutes each month can give you a level of clarity and motivation that changes how you handle money forever.

In this post, we’ll break down why net worth tracking matters, give real-life examples, and show you how it compares to other financial habits.

1. Net Worth Shows Your True Financial Picture

You might think you’re doing well if you’re saving $500 a month. But if your debt is growing faster than your savings, your financial health is moving in the wrong direction.

Example:

- Sarah earns $70,000 a year and saves $500 monthly into her 401(k). Sounds great, right?

- But she also has $25,000 in credit card debt growing at 20% interest.

Without tracking net worth, Sarah feels like she’s making progress. But once she adds it up — her assets ($20k investments + $5k cash) minus liabilities ($25k debt) — she realizes her net worth is negative.

2. It Motivates Better Money Decisions

When you measure something, you naturally want to improve it. Seeing your net worth go up, even a little, makes saving and investing addictive in the best way.

Example:

- John started tracking his net worth in January 2024 at $15,000.

- By December, it hit $25,000.

- That $10,000 gain wasn’t from winning the lottery — it came from making smarter day-to-day choices: paying down a car loan faster, investing monthly, and cutting back on impulse spending.

3. Accountability: You Can’t Improve What You Don’t Measure

If you’ve ever tried to lose weight, you know stepping on the scale creates accountability. Tracking net worth works the same way.

It forces you to face the reality of your finances — the good and the bad. Debt doesn’t stay hidden. Idle savings in a 0.01% bank account stand out. The numbers don’t lie.

Example:

- Maria avoided looking at her student loans for years. When she finally started tracking net worth, she set a goal to pay off $5,000 in 12 months.

- By checking her progress monthly, she hit her goal in 10 months.

4. Net Worth Helps You Focus on Progress, Not Perfection

Markets go up and down. Emergencies happen. You won’t win every financial battle. But tracking net worth shifts your focus to the trend line — the long-term trajectory of your financial health.

Example:

- In March, Alex’s net worth dipped by $8,000 due to market volatility.

- But when he looked at the year as a whole, he was still up $18,000.

That’s the power of zooming out. It prevents panic and reinforces good habits.

5. It Builds a Habit That Actually Sticks

Many financial habits fizzle out:

- Budgeting every dollar? Exhausting.

- Extreme frugality? Hard to sustain.

- Side hustles? Easy to burn out.

But net worth tracking is different. It’s simple, quick, and gives instant feedback. You only need to check it monthly (or quarterly), and the payoff compounds for decades.

Example:

- Emily has tracked her net worth for 7 years. She’s watched it grow from $12,000 to $140,000.

- That habit alone — even without perfect budgeting — kept her consistent through career changes, a move, and market downturns.

6. Net Worth Tracking vs. Other Habits

| Financial Habit | Short-Term Impact | Long-Term Impact | Sustainability |

|---|---|---|---|

| Budgeting | High | Medium | Hard to maintain |

| Cutting Expenses | Medium | Medium | Easy to plateau |

| Side Hustles | High | Depends | Risk of burnout |

| Tracking Net Worth | Low effort | Very High | Highly sustainable |

👉 Net worth tracking is the backbone. You can add budgeting, saving, and investing on top — but without it, you’re flying blind.

7. How to Start Tracking Your Net Worth

You don’t need a degree in finance to start. Here’s how:

- List your assets — savings, investments, property, retirement accounts.

- List your liabilities — credit cards, student loans, mortgage, car loans.

- Subtract liabilities from assets — that’s your net worth.

- Repeat monthly — track the trend over time.

Doing this manually is fine, but most people lose momentum. That’s where a net worth tracker app comes in — automating the process, syncing accounts, and giving you a clear dashboard.

👉 Example: NetTrack automatically connects to your accounts, calculates your savings rate, and shows your progress — without the complexity or bloat of most personal finance apps.

Final Thoughts

If you only build one financial habit this year, make it tracking your net worth.

- It gives you a true snapshot of your finances.

- It motivates better decisions.

- It creates accountability.

- It helps you stay focused on long-term progress.

- And most importantly, it’s a habit that sticks.

Wealth isn’t built overnight. It’s built one decision, one month, and one tracked number at a time.

📈 Start building the habit today with NetTrack — the simple, reliable net worth tracker designed to help you grow wealth without unnecessary complexity.