Building wealth isn’t about luck or guessing the next hot stock. It’s about consistent habits practiced day after day. If you can master a few key financial behaviors and stick with them, your net worth will steadily grow — regardless of market swings or economic cycles.

In this guide, we’ll cover five daily money habits that can transform your financial future. We’ll also break down common mistakes to avoid, examples of how these habits play out in real life, and why consistency is more powerful than quick wins.

Why Habits Matter More Than Income

Most people think net worth growth is all about how much money you make. While income helps, it’s not the full story. There are plenty of high-income earners with little wealth to show because they spend everything (or more) as fast as it comes in.

On the other hand, people with moderate incomes who build the right habits — tracking, saving, investing, and avoiding lifestyle inflation — often end up wealthier long term.

👉 The formula is simple:

Income – Spending + Investing = Growing Net Worth

The hard part? Sticking to daily habits that keep you moving forward.

1. Track Your Finances Every Day

Why It Works

What gets measured gets managed. By tracking your net worth and spending, you keep money top-of-mind and reduce the chance of overspending blindly.

Even if it feels small, daily tracking builds financial awareness. You’ll know where your money is going, spot waste, and stay accountable to your long-term goals.

How to Do It

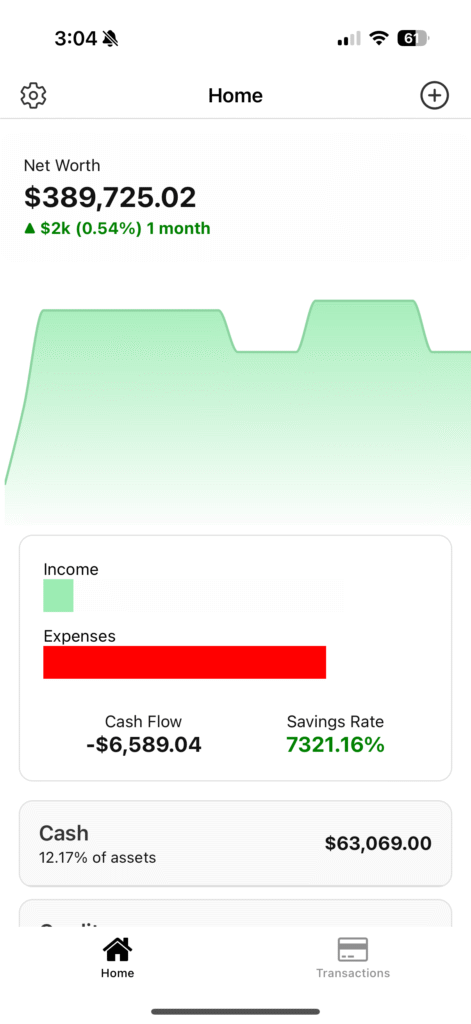

- Use automation: Apps like NetTrack connect your accounts and calculate net worth daily so you don’t have to.

- Spend 2 minutes each morning checking balances and reviewing yesterday’s spending.

- Focus on your savings rate — the percentage of income you keep after expenses. This is one of the most powerful wealth indicators.

Example

Sarah earns $60,000 a year and saves 20% of her income. By checking NetTrack each morning, she noticed subscriptions she wasn’t using ($40/month). Canceling them added $480/year back into her savings — and she wouldn’t have caught it without tracking.

2. Spend Less Than You Earn (and Automate It)

Why It Works

The gap between income and expenses is the fuel for wealth. The larger the gap, the faster your net worth grows. But discipline is hard — which is why automation is key.

How to Do It

- Automate transfers from checking → savings/investing accounts right after payday.

- Treat savings like a bill: non-negotiable.

- Use credit cards wisely — pay balances in full to avoid interest, but enjoy rewards if you’re disciplined.

Mistake to Avoid

- Thinking you’ll “save what’s left.” Spoiler: There’s rarely anything left. Flip it — save first, then spend the rest.

Example

If John automatically invests 15% of each paycheck, he doesn’t have to rely on willpower. Over 10 years, with an average 8% return, that habit alone could grow into six figures.

3. Invest Consistently (Not Emotionally)

Why It Works

Markets are volatile in the short term but reliable in the long term. By investing consistently, you benefit from compounding and dollar-cost averaging — buying more shares when prices are low and fewer when prices are high.

How to Do It

- Set up automatic contributions to a retirement account, index fund, or ETF.

- Start small — even $10–$20/day matters.

- Focus on time in the market, not timing the market.

Example

- Investing $500/month from age 25 to 65 (40 years) with a 10% average return = $3 million+.

- Waiting just 10 years to start reduces that number to about $1.1 million.

The habit of starting early and staying consistent is the difference-maker.

4. Guard Against Lifestyle Inflation

Why It Works

As income rises, spending often rises just as fast. This is called lifestyle creep, and it kills wealth.

The trick is to keep your spending stable while channeling raises and bonuses into savings and investments.

How to Do It

- When you get a raise, commit to saving at least half of it.

- Ask: Does this purchase improve my life, or just my image?

- Prioritize assets (investments, real estate, business equity) over liabilities (cars, gadgets, fancy clothes).

Mistake to Avoid

- Upgrading too quickly (new house, new car, new vacations). Those recurring expenses will eat future raises before you can build wealth.

5. Review and Reflect Regularly

Why It Works

Daily check-ins build awareness, but weekly and monthly reviews drive long-term results. Reflection makes sure your habits are working and keeps motivation high.

How to Do It

- Daily: Quick glance at balances/spending.

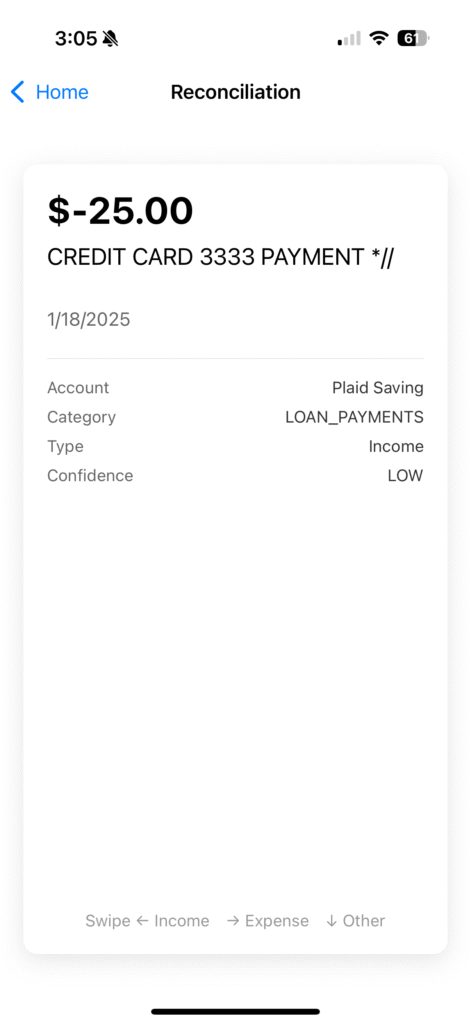

- Weekly: Reconcile accounts, categorize expenses, check net worth trends.

- Monthly: Review goals — debt payoff progress, savings milestones, investment growth.

Example

By reflecting weekly, Lisa noticed her dining-out expenses were creeping higher. Cutting back just 20% saved her $150/month — money she redirected into an index fund.

Common Mistakes That Slow Net Worth Growth

- Not starting early — Compounding works best when you give it decades.

- Chasing “hot tips” — Emotional investing rarely beats steady index investing.

- Ignoring debt — High-interest debt cancels out net worth gains.

- Focusing only on income — Raises don’t matter if every dollar gets spent.

- Lack of consistency — Sporadic saving and investing never builds momentum.

FAQs on Daily Money Habits

Q: Do I really need to check finances every day?

A: Even 2 minutes daily builds awareness. Over time, it becomes second nature.

Q: What if I can’t save much right now?

A: Start small. Even $5/day invested grows over decades. The habit matters more than the amount in the beginning.

Q: Should I pay off debt or invest first?

A: Focus on high-interest debt first (credit cards, personal loans). Once that’s under control, split between investing and saving.

Q: Is tracking net worth really that important?

A: Yes — it’s the single best way to measure financial progress. Income and savings don’t tell the full story, but net worth does.

Final Thoughts

Growing your net worth isn’t about dramatic moves. It’s about small, repeatable habits that compound into something big. Track your finances, spend less than you earn, invest consistently, avoid lifestyle creep, and review regularly.

If you stick with these habits for years, your future self will thank you.

💡 Ready to take control of your financial future? NetTrack makes it simple to connect accounts, track net worth automatically, and build momentum with daily insights.