Understanding what you own is just as important as knowing how much you own.

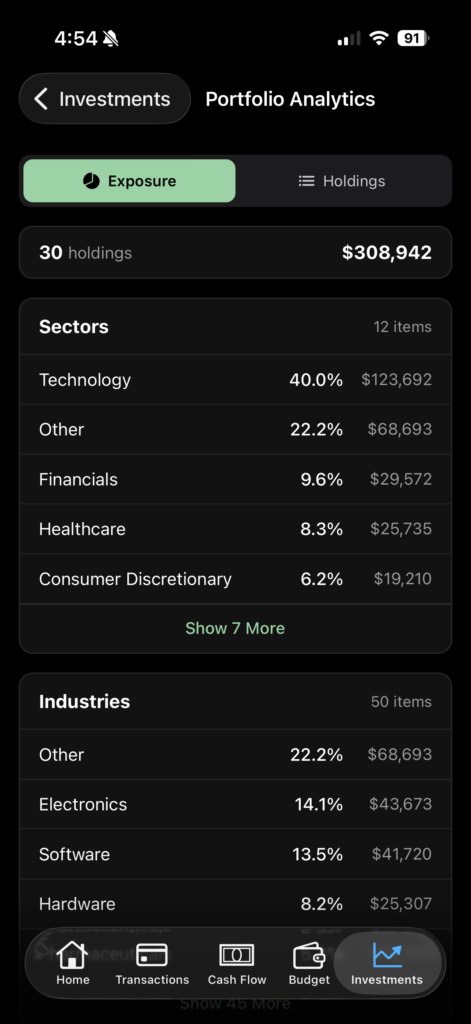

That’s why the latest NetTrack release introduces Portfolio Analytics — a powerful new way to visualize your investment exposure across sectors, industries, and countries, all in one place.

Why Portfolio Analytics Matters

Most investors think they’re diversified… until they actually see the breakdown.

Portfolio Analytics helps you answer questions like:

- Am I overexposed to tech?

- How much of my portfolio is tied to a single industry?

- Do I have meaningful international exposure?

- Where are my hidden concentration risks?

Instead of guessing, you can now see your true asset allocation instantly.

Sector Exposure at a Glance

NetTrack automatically categorizes your holdings by sector and shows:

- Percentage allocation

- Dollar value per sector

- Total portfolio exposure

This makes it easy to spot imbalances, such as a tech-heavy portfolio or underweighting healthcare or financials — especially useful if you’re aiming for long-term diversification.

Industry-Level Insights

Sectors only tell part of the story.

Portfolio Analytics goes deeper with industry-level breakdowns, letting you see exposure to areas like:

- Software

- Electronics

- Hardware

- Financial services

- Healthcare sub-industries

This is where hidden risk often lives. Two funds may look diversified on the surface, but still concentrate heavily in the same industries underneath.

Country & Geographic Exposure

Global diversification matters.

With country-level exposure, you can quickly understand:

- How much of your portfolio is domestic vs international

- Whether you’re overly dependent on a single country’s market

- Your true geographic risk profile

This is especially valuable for investors holding ETFs and mutual funds where geographic exposure isn’t always obvious.

What’s Next

Portfolio Analytics is just the beginning.

Future updates will build on this foundation with deeper insights, longer-term trends, and smarter analysis to help you make better decisions with confidence.

If you’ve ever wondered, “What am I actually invested in?” — now you know.

Leave a Reply